Dublin, Nov. 19, 2024 (GLOBE NEWSWIRE) — The “Health Insurance for UAE Complementary and Alternative Therapy Market Size, Share and Trends Analysis Report by Treatment (Physiotherapy, Homeopathy, Ayurveda, Naturopathy, Psychology, Chiropractic, Acupuncture, Osteopathy) 2024-2030” report has been added to ResearchAndMarkets.com’s offering.

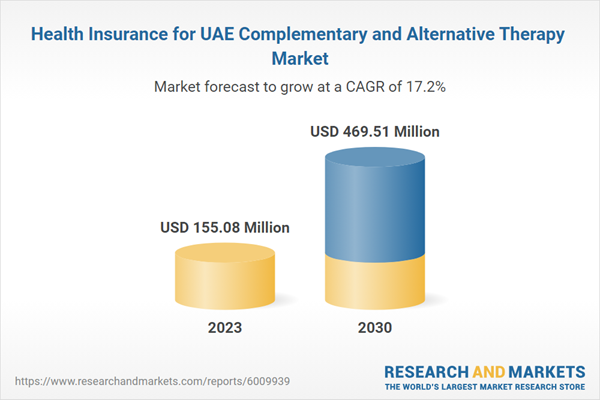

The health insurance for UAE complementary and alternative therapy market is anticipated to reach USD 469.51 million by 2030 and is anticipated to expand at a CAGR of 17.17% from 2024 to 2030

The growth of the market can be attributed to increasing government initiatives and regulations expanding coverage for these treatments. The rising consumer demand for alternative therapies, combined with the wide availability of coverage plans and offerings, is supporting this growth. Furthermore, the growing preference for holistic and natural treatment options is further driving the expansion of the market.

The increasing demand for natural treatment options in the UAE is restructuring the insurance setting for CAM therapies. As awareness grows and consumer preferences shift toward holistic health solutions, insurance providers are responding by incorporating these therapies into their coverage plans. This evolution reflects a broader acceptance of CAM in the healthcare system, driven by demographic trends and government initiatives aimed at enhancing the overall health & wellness of the population.

For instance, EBP in Dubai now includes coverage for treatments, such as homeopathy & Ayurveda, making these services more accessible to low-income residents. In addition, insurance providers, such as Oman Insurance Company, are now covering a wide range of CAM therapies, including homeopathy, Ayurveda, and Traditional Chinese Medicine (TCM). This coverage is offered through networks of recognized clinics, making these therapies more accessible to the public.

Health Insurance For UAE Complementary And Alternative Therapy Market Report Highlights

- On the basis of treatment, the physiotherapy segment held the largest market share in 2023. This is attributed to the growing population, increasing prevalence of lifestyle-related musculoskeletal disorders, and enhanced health coverage due to government initiatives improving accessibility and reducing out-of-pocket costs.

- The homeopathy segment is projected to experience the fastest growth due to its potential to lower hospitalization duration, medication use, and overall healthcare costs, alongside its effectiveness in enhancing well-being and managing chronic conditions, driving rising patient interest and demand for coverage.

- For instance, in September 2022, Policybazaar partnered with Adamjee Insurance to offer comprehensive health coverage to Pakistani nationals in the UAE. This partnership aims to facilitate access to inclusive health coverage plans for their dependents, covering both UAE and Pakistan, through Policybazaar.

The leading players in the Health Insurance for UAE Complementary and Alternative Therapy market include:

- Cigna Healthcare

- Daman

- GIG

- MetLife UAE (Gulf)

- Allianz Care

- Aetna Inc.

- Sukoon Insurance PJSC

- Nextcare

- Salama Islamic Arab Insurance Company

- MEDGULF

- United Fidelity Insurance PSC

- Al Buhaira National Insurance Company (ABNIC)

- Adamjee Insurance

- ADNIC

- Takaful Emarat

- Watania

- RAKINSURANCE

- Oriental Insurance

- Arabia Insurance Company

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 172 |

| Forecast Period | 2023 – 2030 |

| Estimated Market Value (USD) in 2023 | $155.08 Million |

| Forecasted Market Value (USD) by 2030 | $469.51 Million |

| Compound Annual Growth Rate | 17.1% |

| Regions Covered | United Arab Emirates |

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Rising government initiatives and regulations for health insurance for complementary and alternative therapy in the UAE

3.2.1.2. Rising demand for alternative therapies

3.2.1.3. Wide availability of coverage plans/offerings by insurance providers

3.2.2. Market restraint analysis

3.2.2.1. Limited awareness & acceptance of complementary and alternative medicine (CAM)

3.2.2.2. Limited sum limits for CAM insurance coverage

3.3. Industry Opportunity Analysis

3.3.1. Growing demand for holistic and natural treatment options

3.4. Industry Challenges Analysis

3.4.1. Lack of integration between CAM and conventional healthcare providers

3.5. Business Environment Analysis Tools

3.5.1. Porter’s Five Forces Analysis

3.5.2. PESTLE Analysis

3.6. Regulatory Framework

3.7. Qualitative Analysis

3.7.1. Sum Limits in Complementary and Alternative Therapies Insurance Coverage

3.7.2. Coverage Criteria for CAM Therapies In UAE

3.7.3. Comparative Analysis on Health Insurance for CAM Therapies in UAE & Other Countries

3.7.3.1. UAE

3.7.3.2. U.S.

3.7.3.3. India

3.7.3.4. Europe Countries:

3.7.3.4.1. Germany

3.7.3.4.2. Switzerland

3.7.3.4.3. UK

3.7.3.4.4. France

3.7.4. Cost Comparison Analysis: CAM Therapies Vs Conventional Therapies

3.7.5. Long-term Financial Benefits Analysis for Insurance Companies

3.7.6. Economic Impact of Insurance Coverage for Complementary and Alternative Medicine Therapies

3.7.7. Review of Literature on Health Outcomes from CAM Therapies

3.7.8. Evaluating the effectiveness of CAM therapies in improving patient health

3.7.9. Economic Advantages of Integrating CAM Therapies into Preventive Care

3.7.10. Consumer Behavior and Demand for CAM Therapies

Chapter 4. Treatment Business Analysis

4.1. Segment Dashboard

4.2. Treatment Movement & Market Share Analysis, 2023 & 2030

4.3. Health Insurance for UAE Complementary and Alternative Therapy Market Size & Forecast and Forecasts, By Treatment (USD Million)

4.4. Homeopathy

4.4.1. Homeopathy market, 2018-2030 (USD Million)

4.5. Ayurveda

4.6. Acupuncture

4.7. Osteopathy

4.8. Herbal and Traditional Chinese Medicine (TCM)

4.9. Naturopathy

4.10. Chiropractic

4.11. Physiotherapy

4.12. Psychology

4.13. Counselling

4.14. Nutrition Counselling

4.15. Life Coaching

Chapter 5. Competitive Landscape

5.1. Company Categorization

5.2. Company Market Position Analysis

5.3. Strategy Mapping

5.4. Company Profiles/Listing

5.4.1. Overview

5.4.2. Financial performance

5.4.3. Coverage benchmarking

5.4.4. Strategic initiatives

For more information about this report visit https://www.researchandmarkets.com/r/qklp7q

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.